A Study on the Price and Investment Return of Colourless Diamond in Auction Market

-

摘要:

随着金融体系的风险增加,越来越多的投资者将目光转向了能够作为价值储存手段的另类资产。钻石因其稀缺性、耐久性和便携性等特点,被视为具有投资潜力的商品。为了帮助投资者明晰无色钻石的投资潜力,本文研究了2009年至2022年期间拍卖市场无色钻石的风险回报特征。在研究期内,不同品质无色钻石投资表现具有一定差异,其中高品质、无色钻石的回报最差,在研究期间不是一个很好的投资选择;中等品质无色钻石的回报优于同时期债券和贵金属,可以考虑纳入资产组合。此外,本文运用享乐回归法探讨了影响拍卖市场无色钻石价格的因素,其中“4C”分级和是否来自奢侈品品牌对无色钻石价格的影响尤为显著,该模型能够解释95 % 以上的无色钻石价格变化。最后,笔者对其他投资资产与拍卖市场无色钻石进行了相关性分析,结果表明无色钻石与其他资产不存在显著的相关性,证明在其他资产的投资组合中加入无色钻石会有一定的分散风险能力。

Abstract:As the financial system risks escalate, an increasing number of investors are turning their attention to alternative assets as a means of value storage. Diamonds, characterized by their scarcity, durability, and portability, are viewed as commodities with investment potential. To elucidate the investment potential of colourless diamonds for investors, this study examines the risk-return characteristics of colourless diamonds in the auction market from 2009 to 2022. Varying performance was observed among different qualities of colourless diamonds, with high-quality ones yielding the poorest returns, indicating they were not a favorable investment option during the studied period. Conversely, medium-quality colourless diamonds outperformed bonds and precious metals during the same period, making them a viable addition to investment portfolios. Furthermore, this study employs hedonic regression analysis to explore factors influencing the prices of colourless diamonds in the auction market. Notably, the "4Cs" grading system and association with luxury brands significantly impact colourless diamond prices, with the model explaining over 95% of price variations. Lastly, a correlation analysis between other investment assets and colourless diamonds in the auction market reveals no significant correlation, demonstrating that incorporating colourless diamonds into portfolios can offer diversification benefits and mitigate risk.

-

Keywords:

- auction /

- diamond /

- hedonic modeling /

- alternative investment

-

钻石作为宝石之王,自古以来便因其独特的火彩和稀缺性而备受追捧。随着全球经济的不断发展和人们财富的增加,钻石的投资和收藏价值日益凸显,特别是在拍卖市场中,钻石的交易价格更是屡创新高。

拍卖市场作为高端珠宝交易的重要平台,具有其独特的运作机制和价格形成机制。相较一级交易市场,拍卖市场的透明度更高,买卖双方通过竞价方式确定最终交易价格,这一过程充分反映了市场对钻石价值的认可程度。同时,拍卖市场的竞争性和公开性也使得钻石价格更加公正和合理。然而,钻石价格的形成是一个复杂而多元的过程,涉及多个方面的影响因素,需要进行较为全面的分析。

在全球经济不确定性和金融市场波动加剧的背景下,投资者对资产配置的需求日益多样化[1]。传统资产如股票、债券等受到市场波动的影响较大,投资者开始寻求更为稳健和安全的投资渠道。黄金[2-14]和其他贵金属[15-18]作为避险资产,已经得到充分研究。钻石作为一种具有稀缺性、耐久性和便携性的资产,引起了众多投资者与学术界的关注[19-22],逐渐受到投资者的青睐。

Auer和Schuhmacher(2013)[23]率先指出,在股市表现疲软时,包含钻石的多元化投资组合能够超越传统股票市场的表现,强调了钻石作为投资组合多元化工具的价值,特别是1.0克拉钻石展现出最优表现。然而,这种优势的实现依赖于较高(30%)的钻石投资比重,这一发现为后续研究提供了重要参考。随后,Auer(2014)[24]进一步确认了上述结论,并揭示了钻石投资绩效相较于黄金和白银的劣势,及其在避险和对冲股市及汇率风险方面的局限性,表现为一种弱对冲和弱避险工具。Low和Faff(2016)[25],通过对比实物钻石与钻石指数的表现,发现仅在市场剧烈波动时期,高品质实物钻石才能保持其价值,而钻石指数在避险和对冲国际金融市场风险方面的作用有限。此外,D’Ecclesia和Jotanovic(2018)[26]深入探讨了不同质量等级钻石的投资特性,指出中等质量钻石可作为黄金投资者的对冲工具,而高质量钻石则成为全球股票市场的有效对冲工具,这一发现挑战了以往关于钻石作为弱对冲工具的普遍认知。然而,现有研究多依赖于国际钻石报价指数(如PolishedPrices提供的数据),这些数据虽具有参考价值,但并非真实交易记录,其代表性和准确性受到质疑。

Renneboog和Spaenjers(2012)[27]通过分析钻石拍卖市场的交易价格,得出了与Low和Faff(2016)的研究相反的结论,即钻石的回报与股票的回报正相关,证明在高端珠宝拍卖市场存在财富效应。Jotanovic和D’Ecclesia(2019)[28]通过考察钻石生产公司股票的表现,发现其价格与收益主要受当地股票市场影响,而非直接关联于钻石价格,从而否定了将钻石生产商股票作为钻石投资替代品的观点。Barbi、Geman和Romagnoli(2020)[29]的研究,通过对比钻石、黄金及贵金属在减轻多元化股票市场投资组合尾部风险方面的表现,得出了钻石具有更强多元化投资潜力的结论。这一发现为钻石在全球市场投资组合中的应用提供了新的视角。

综上所述,尽管现有文献已对钻石投资的潜力进行了初步探索,但对于拍卖市场钻石投资属性的相关研究较为有限,尤其是与实物钻石投资收益能力相关的深入分析较为匮乏,多数现有研究聚焦于钻石价格指数与金融市场指数之间的相关性分析,试图揭示钻石在投资组合中的潜在作用。本文运用2008年至2022年全球8个拍卖行的无色裸石及单独镶嵌钻石的拍卖数据,利用享乐模型构建价格指数,分析影响其价格的因素并探究其投资属性,填补了以往研究依赖报价指数数据的空白,为投资者提供了基于实际市场数据的决策参考,提高了研究结果的代表性和可靠性。

1. 研究数据及模型

1.1 研究数据来源及统计

本研究使用的数据来源于各拍卖行官方网站。数据库包含佳士得、苏富比、邦瀚斯、保利、中国嘉德、北京瀚海、北京匡时、菲利普斯等八家拍卖行的珠宝拍卖数据。为了避免群镶配石对价格的影响, 笔者选用2008年至2022年各拍卖行珠宝专场拍买中0.1 ct以上无色钻石裸石及单独镶嵌无色钻石(统一简称为“无色钻石”)的相关数据作为研究对象,共包含3 741条销售信息。表 1是对数据集以半年为周期的描述性统计,所有价格均按拍卖当日汇率兑换为美元。

结果(表 1)显示,拍卖市场的无色钻石价格差异极大,且平均价格在不同时间段变化较大。例如,2008年至2013年上半年间,无色钻石平均单件价格在12万美元至30万美元间,2013年下半年至2016年上半年无色钻石平均价格在27万美元至56万美元,成交价几乎翻了一番。

表 1 2008年至2022年无色钻石裸石及单独镶嵌无色钻石拍卖价格统计Table 1. Statistics of auction prices of colourless diamond loose stones and individually inlaid colourless diamonds from 2008 to 2022时间 样本量/件 平均价格/万美元 平均克拉单价/万美元 最高价/万美元 最低价/万美元 2008上 61 22.517 2.862 334.181 0.144 2008下 82 12.301 1.778 189.114 0.185 2009上 51 13.198 1.999 151.579 0.182 2009下 54 15.583 1.464 411.450 0.236 2010上 109 28.971 2.503 797.439 0.318 2010下 172 14.519 1.892 366.650 0.234 2011上 149 31.541 2.594 1 094.030 0.110 2011下 111 29.881 2.837 827.696 0.256 2012上 101 23.286 2.478 397.973 0.268 2012下 88 22.238 2.086 344.250 0.150 2013上 151 30.566 2.044 1 416.500 0.134 2013下 127 51.960 2.798 3 077.950 0.095 2014上 172 56.530 2.507 1 466.740 0.373 2014下 172 27.188 2.334 1 108.500 0.255 2015下 167 45.157 2.459 2 209.000 0.148 2015下 132 28.948 2.347 783.472 0.373 2016上 131 29.250 2.069 722.100 0.283 2016下 114 17.127 1.613 556.750 0.166 2017上 133 25.022 2.139 524.299 0.375 2017下 185 17.484 1.837 498.197 0.364 2018上 145 35.185 2.278 926.164 0.350 2018下 197 17.230 1.622 397.500 0.303 2019上 117 35.712 1.989 1 375.760 0.259 2019下 71 17.807 1.920 182.765 0.252 2020上 34 13.534 1.736 211.500 0.202 2020下 78 38.749 1.677 1 568.560 0.199 2021上 82 65.244 3.192 1 412.510 0.138 2021下 41 64.624 3.207 529.513 0.336 2022上 333 19.554 1.410 2 183.160 0.050 2022下 181 13.100 1.548 296.570 0.060 总计 3 741 28.800 2.174 878.729 0.227 注:“时间”中的“上”表示当年的上半年,“下”表示当年的下半年 然而,平均价格并不能代表整体价格的真实水平,上涨很有可能是高品质无色钻石的成交带来的结果。图 1显示了数据集中所有样本的价格分布情况(价格分位数即数据集中每个样本的价格在全样本中的总体水平中排序的高低,0为价格最低,1为价格最高)。结果显示,无色钻石的拍卖价格呈倒L形分布,表明大多数无色钻石价格较低,集中在左尾,而少数昂贵的高品质无色钻石分散在右尾,因此本文基于享乐回归模型构建无色钻石的价格指数并运用分位数回归对其进行异质性检验,探究享乐模型的稳健性。

1.2 享乐模型及其运用

享乐模型经常被用于估计其他具有异质性和不经常交易的资产的回报,例如房地产[30]、艺术品[31-39]、葡萄酒[40-48]等。该模型的两个核心假设是商品的异质性和市场的隐含性。商品异质性是指商品在内在特征方面的个体差异。商品的价格取决于其对于消费者的效用水平,内在特征的种类和数量决定了效用水平的高低,进而决定商品价格。钻石是一种异质性很强的商品(即个体差异大),其价格取决于内在特征和交易环境。享乐模型能将钻石价格与钻石自身特征、销售环境有机的联系在一起。假设享乐特征捕捉了钻石的质量,时间虚拟变量的回归系数则代表每个时期的价格水平。根据不同时期的价格水平可对当期收益率进行估计。享乐回归的表达式为公式(1)。

$$ \ln P_{\mathrm{kt}}=\alpha+\sum\limits_{m=1}^M \beta_{\mathrm{m}} X_{\mathrm{mkt}}+\sum\limits_{t=1}^T \gamma_{\mathrm{t}} \mathrm{~d}_{\mathrm{kt}}+\varepsilon_{\mathrm{kt}} $$ (1) 其中,Pkt表示无色钻石k在t时间的价格,Xmkt表示影响钻石k在t时间上特征m的值,dkt是一个时间虚拟变量,如果无色钻石k在时间t出售,其值为1(否则为0)。系数βm反映了钻石影子价格对特征m的归属,而系数γt的反对数变化用于计算T个时间段内的收益。

享乐特征的选择是至关重要的,这些变量需要尽可能精确地捕捉每个观测对象影响无色钻石质量且不随时间变化的特征。数据库包含了许多可能影响钻石拍卖价格的内部及外部特征信息,包括钻石克拉重量、色级、净度、琢形、证书、品牌、拍卖行、拍卖地等。首先需要关注的是公认对无色钻石价值影响最大的钻石“4C”分级。4C分级包括钻石克拉重量、颜色、净度及切工。根据数据集特征,可将无色钻石色级分为D、E、F、G、H、I-J、K-L、M-Z以及其他(色级未标明)9个级别;将净度分为FL(无暇)、IF(内部无暇)、VVS(极微瑕)、VS(微瑕)、SI(瑕疵)、SI以下和其他(净度未标明)等7个级别;因拍卖极少会披露钻石切工等级,此处用“琢型”代替,分为圆型、方型(包括公主型、祖母绿型、阶梯型等)、橄榄型(马眼型)、梨形(水滴型)、垫型(枕型)、心型和椭圆型,不属于上述常见琢型则被命名为其他琢型,如环形切割、过渡型等,从而探究拍卖市场中不同琢型的无色钻石受欢迎的程度。

其次,笔者还收集了拍卖行、拍卖地点、拍卖时间、钻石是否具有证书、是否为某高级品牌产品等外部特征。数据集包括全球8家拍卖行(佳士得,苏富比,邦瀚斯及保利、中国嘉德、北京瀚海、北京匡时、菲利普斯)的销售数据,除佳士得,苏富比,邦瀚斯外,其余5家拍卖行15年间的交易量均小于50次,于是合并命名为“其他拍卖行”。数据集中大多数拍卖地为英国、美国、瑞士、中国、法国等,由于15年间在荷兰、阿联酋的交易量未满50次,于是将此两地合并命名为“其他拍卖地”。此外,笔者为无色钻石设置了“品牌”和“证书”两个虚拟变量,若无色钻石来自某高级珠宝品牌,如宝格丽、卡地亚、格拉夫、蒂芙尼、梵克雅宝等,那么品牌虚拟变量等于1(否则为0);若无色钻石具有来自专业实验室颁发的真伪证书时,证书虚拟变量为1(否则为0),表 2显示了选取特征的描述性统计。

表 2 享乐模型特征变量描述性统计Table 2. Descriptive statistics of characteristic variables in the hedonic pricing model色级 样本/件 占比/% 净度 样本/件 占比/% 琢形 样本/件 占比/% D 630 16.84 FL 117 3.13 其他 78 2.09 E 341 9.12 IF 288 7.70 圆型 2 460 65.76 F 332 8.87 VVS 923 24.67 垫型 157 4.20 G 319 8.53 VS 1 569 41.94 心型 120 3.21 H 275 7.35 SI 649 17.35 方型 513 13.71 I-J 608 16.25 SI以下 188 5.03 梨型 224 5.99 M-Z 685 18.31 其他 7 0.19 椭圆型 68 1.82 其他 77 2.06 橄榄型 121 3.23 拍卖行 样本/件 占比/% 拍卖地 样本/件 占比/% 品牌 样本/件 占比/% 佳士得 1 096 29.30 中国 468 12.51 国际知名品牌 286 7.65 苏富比 1 671 44.67 其他 39 1.04 未披露 3 455 92.35 邦瀚斯 875 23.39 意大利 69 1.84 证书 样本/件 占比/% 其他 99 2.65 法国 236 6.31 有证书 2 403 64.23 澳大利亚 68 1.82 未披露 1 338 35.77 注:“色级”“净度”中的“其他”表示该项未标明;“琢型”中“其他”表示不属于常见琢型;“拍卖行”中“其他”表示保利、中国嘉德、北京瀚海、北京匡时和菲利普斯;拍卖地中“其他”表示荷兰、阿联酋;合计样本量3 741件 2. 数据分析

2.1 无色钻石价格的影响因素及异质性检验

2.1.1 无色钻石价格的影响因素

享乐模型认为商品特征对价格的影响是不随时间变化的,考虑到本研究期相对较短,这一假设被认为是合理的。模型采用最小二乘法对无色钻石的名义价格(所有样本均以美元计价)进行回归估计,表 3显示了享乐模型的估计结果。为了避免多重共线性, 为每个虚拟变量设置了一个基准变量用作计算边际效应的基准。本研究将D色作为颜色级别的基准变量;FL作为净度的基准变量;橄榄型作为琢型的基准变量;未披露品牌信息、未披露证书信息作为基准变量;英国作为拍卖地的基准变量,拍卖行佳士得作为拍卖行的基准变量。对于纳入模型的变量,得到了系数、标准差以及t统计量和p统计量为了观察变量的经济意义还报告了变量差异对价格的影响比率,计算方法为系数的指数减去1。

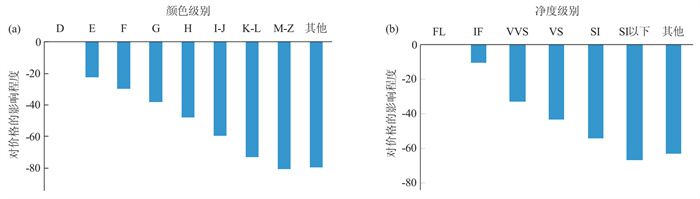

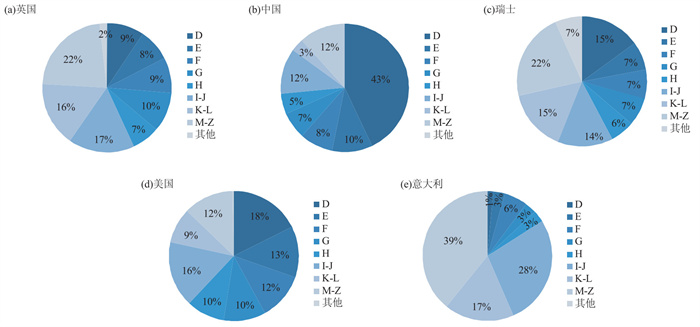

表 3 享乐回归结果Table 3. Results of hedonic regression影响因素 系数 标准差 t P>t 影响/% 重量 ln(克拉重量) 1.915 0.021 89.510 0 578.5 ln(克拉重量)2 -0.062 0.006 -10.990 0 -6.0 色级 D Benchmark - - - - E -0.253 0.025 -9.920 0 -22.3 F -0.356 0.026 -13.720 0 -30.0 G -0.479 0.026 -18.100 0 -38.1 H -0.647 0.028 -23.110 0 -47.7 I-J -0.899 0.024 -37.310 0 -59.3 K-L -1.306 0.027 -48.340 0 -72.9 M-Z -1.645 0.026 -63.710 0 -80.7 未标明 -1.588 0.048 -33.010 0 -79.6 净度 FL Benchmark - - - - IF -0.108 0.041 -2.620 0.009 -10.2 VVS -0.400 0.039 -10.240 0 -33.0 VS -0.569 0.039 -14.520 0 -43.4 SI -0.785 0.042 -18.900 0 -54.4 SI以下 -1.103 0.048 -23.030 0 -66.8 未标明 -1.001 0.141 -7.100 0 -63.3 琢形 橄榄型 Benchmark - - - - 其他 0.022 0.055 0.410 0.682 2.3 圆型 0.119 0.034 3.450 0.001 12.6 垫型 0.071 0.044 1.600 0.110 7.3 心型 -0.076 0.047 -1.630 0.104 -7.3 方型 -0.078 0.037 -2.140 0.032 -7.5 梨型 -0.028 0.041 -0.680 0.496 -2.7 椭圆型 0.001 0.055 0.010 0.992 0.1 品牌 未披露 Benchmark - - - - 国际知名品牌 0.175 0.023 7.750 0 19.1 证书 未披露 Benchmark - - - - 有证书 -0.002 0.018 -0.120 0.903 -0.2 地点 英国 Benchmark - - - - 中国 0.260 0.025 10.340 0.000 29.7 其他 -0.031 0.061 -0.500 0.616 -3.0 意大利 -0.110 0.049 -2.240 0.025 -10.4 法国 0.007 0.028 0.240 0.808 0.7 澳大利亚 -0.049 0.047 -1.060 0.289 -4.8 瑞士 0.127 0.020 6.360 0.000 13.6 线上 0.065 0.045 1.450 0.146 6.7 美国 0.090 0.019 4.710 0.000 9.4 拍卖行 佳士得 Benchmark - - - - 苏富比 -0.016 0.016 -1.000 0.319 -1.5 邦瀚斯 -0.157 0.022 -7.240 0 -14.6 其他 0.067 0.041 1.630 0.103 7.0 Prob >F=0 R2=0.950 9 N=3 741 Adj R2=0.950 1 注:“琢型”中“其他”表示不属于常见琢型;“地点”中“其他”表示日内瓦、荷兰、阿联酋;“拍卖行”中的“其他”表示保利、中国嘉德、北京瀚海、北京匡时、菲利普斯 表 3显示了研究选取的享乐变量对价格均有重大影响。一般来说,钻石质量和价格之间存在非常密切的关系。如果从模型中忽略钻石质量的平方项,ln(克拉重量)的系数大于1,表明一般情况下,价格的增长比例会大于克拉重量的增长比例。如图 2所示,与D色级钻石相比,E、F、G、H的价格会相应减少22.3%、30.0%、38.1%以及47.7%;相较于无暇级无色钻石,内部无瑕级无色钻石的价格会下降10.2%,极微瑕级会下降33.0%,微瑕级价格下降43.4%,瑕疵级降低54.4%。对于琢形而言,圆型无色钻石相较于橄榄型钻石具有明显的溢价,溢价比率在12.6%;而方型无色钻石较橄榄型钻石具有比较显著的折价,比率为7.5%;其余琢型的溢价及折扣比率均无显著的统计学差异。回归结果显示,出自高级珠宝品牌(如Bulgari、Cartier、Graff、Tiffany及Van Cleef & Arpels等)的无色钻石相较于一般无色钻石具有19.1%的溢价。然而具有专业实验室出具的真伪证书的无色钻石却不具有显著的溢价。这可能是因为出现在国际著名拍卖行中的无色钻石在拍卖行担保下均具有较强的可信度。相较于在英国拍卖,在中国拍卖可获得29.7%的溢价,在瑞士会获得13.6%的溢价,在美国具有9.4%的溢价,而在意大利会有10.4%的折价。然而,值得注意的是,不同地点之间的价格差异可能反映了不同地区拍卖无色钻石平均质量等其他不可观察的差异,如图 3所示中国、瑞士、美国拍卖的高质量无色钻石占比明显多于英国,而意大利拍卖的高品质无色钻石占比明显低于其他国家。根据回归结果,可以看到在邦瀚斯拍卖的无色钻石价格相较于佳士得拍卖的无色钻石有14.6%的折价,而苏富比和其他拍卖行相较于佳士得不具有统计学上的显著差异。

2.1.2 异质性检验

由于数据集中无色钻石的拍卖价格呈倒L形分布,大多数无色钻石价格较低,集中在左尾,而少数昂贵的高品质无色钻石分散在右尾,所以无色钻石拍卖市场可能存在较强的异质性,此时单一享乐模型无法准确描述整个市场,所以笔者将运用分位数回归对其进行异质性检验,估计在0.3、0.5、0.7分位数水平上享乐价格的表现。

表 4显示了完整样本及在各分位数水平下享乐回归的结果。由表 4可知,所有享乐特征在全样本上与在各个分位数上的表现大致相同(系数符号相同且数值差异不大)。结果显示:(1)在全样本及各分位水平下,无色钻石成交价格均随着色级、净度等质量特征评级的下降而降低;(2)圆型无色钻石对橄榄型无色钻石而言存在溢价;(3)出自高级珠宝品牌的无色钻石相较于一般无色钻石有显著的溢价;(4)在中国、瑞士、美国售出的无色钻石均具有显著的溢价,对于在佳士得售出的无色钻石而言,邦瀚斯售出的钻石具有明显的折价。分位数回归结果表明,无色钻石拍卖市场不存在明显的异质性,享乐回归可以被用于无色钻石拍卖市场的研究。

表 4 全样本及分位数享乐回归结果Table 4. Full sample and quantile hedonic regression results影响因素 全样本 0.3 0.5 0.7 系数 标准差 系数 标准差 系数 标准差 系数 标准差 重量 ln(克拉重量) 1.915*** 0.021 2.051*** 0.031 2.026*** 0.029 2.044*** 0.034 ln(克拉重量)2 -0.062*** 0.006 -0.092*** 0.008 -0.084*** 0.007 -0.087*** 0.010 色级 D Benchmark - Benchmark - Benchmark - Benchmark - E -0.253 *** 0.025 -0.227*** 0.031 -0.229*** 0.031 -0.254*** 0.037 F -0.356*** 0.026 -0.311*** 0.027 -0.356*** 0.026 -0.367*** 0.032 G -0.479*** 0.026 -0.415*** 0.028 -0.452*** 0.025 -0.455*** 0.032 H -0.647*** 0.028 -0.561*** 0.031 -0.598*** 0.030 -0.637*** 0.032 I-J -0.899*** 0.024 -0.878*** 0.024 -0.897*** 0.031 -0.919*** 0.036 K-L -1.306*** 0.027 -1.309*** 0.033 -1.298*** 0.035 -1.300*** 0.042 M-Z -1.645*** 0.026 -1.649*** 0.031 -1.677*** 0.031 -1.725*** 0.043 未标明 -1.588*** 0.048 -1.644*** 0.042 -1.681*** 0.059 -1.692*** 0.080 净度 FL Benchmark - Benchmark - Benchmark - Benchmark - IF -0.108*** 0.041 -0.149*** 0.056 -0.127** 0.054 -0.151** 0.059 VVS -0.400*** 0.039 -0.432*** 0.051 -0.411*** 0.052 -0.397*** 0.065 VS -0.569*** 0.039 -0.592*** 0.049 -0.586*** 0.051 -0.575*** 0.062 SI -0.785*** 0.042 -0.827*** 0.049 -0.787*** 0.053 -0.760*** 0.065 SI以下 -1.103*** 0.048 -1.182 *** 0.063 -1.037*** 0.077 -0.979*** 0.071 未标明 -1.001*** 0.141 -0.975*** 0.544 -1.003** 0.432 -0.554 0.458 琢型 橄榄型 Benchmark - Benchmark - Benchmark - Benchmark - 其他 0.022 0.055 0.101 0.065 0.085 0.065 0.073 0.071 圆型 0.119*** 0.034 0.150*** 0.052 0.158*** 0.042 0.157*** 0.035 垫型 0.071 0.044 0.061 0.054 0.051 0.051 0.087 0.053 心型 -0.076 0.047 -0.071 0.057 -0.043 0.056 -0.009 0.047 方型 -0.078** 0.037 -0.067 0.052 -0.051 0.043 -0.067* 0.038 梨型 -0.028 0.041 -0.036 0.062 -0.021 0.053 0.013 0.047 椭圆型 0.001 0.055 0.048 0.076 0.017 0.060 -0.007 0.057 品牌 未披露 Benchmark - Benchmark - Benchmark - Benchmark - 国际知名品牌 0.175*** 0.023 0.116*** 0.026 0.153*** 0.034 0.220*** 0.032 证书 未披露 Benchmark - Benchmark - Benchmark - Benchmark - 有证书 -0.002 0.018 -0.021 0.018 0 0.020 -0.009 0.019 地点 英国 Benchmark - Benchmark - Benchmark - Benchmark - 中国 0.260*** 0.025 0.269*** 0.023 0.259*** 0.030 0.297*** 0.028 其他 -0.031 0.061 0.105 0.082 0.082 0.062 0.149* 0.087 意大利 -0.110** 0.049 -0.073 0.046 -0.059 0.062 -0.063 0.050 法国 0.007 0.028 -0.017 0.026 -0.045* 0.025 -0.045 0.035 澳大利亚 -0.049 0.047 -0.029 0.047 -0.047 0.042 -0.053 0.051 瑞士 0.127*** 0.020 0.155*** 0.018 0.132*** 0.021 0.142*** 0.021 线上 0.065 0.045 -0.111 0.045 -0.173 0.052 -0.127 0.057 美国 0.090*** 0.019 0.107*** 0.016 0.084*** 0.019 0.072*** 0.017 拍卖行 佳士得 Benchmark - Benchmark - Benchmark - Benchmark - 苏富比 -0.016 0.016 -0.025 0.016 -0.016 0.017 -0.024 0.018 邦瀚斯 -0.157*** 0.022 -0.044** 0.022 -0.060** 0.024 -0.076*** 0.025 其他 0.067 0.041 -0.091 0.058 0.022 0.053 0.009 0.051 注:“*”“**”“***”分别表示在10%,5%,1%水平上具有统计显著性;“地点”中的“其他”表示日内瓦、荷兰、阿联酋;“拍卖行”中“其他”表示保利、中国嘉德、北京瀚海、北京匡时、菲利普斯 2.2 无色钻石价格指数

为了探究不同品质无色钻石的投资回报是否具有显著差异,我们将总样本中H色以上、净度VS以上、克拉重在10 ct以上的无色钻石标记为“高质量钻石”;将I-L色、净度VVS-VS、3~10 ct的无色钻石标记为“中等质量钻石”;将净度SI及以下、3 ct以下的无色钻石标记为“低质量钻石”。表 5中显示了以美元计算的无色钻石名义回报率,这些回报计算方式为两个连续周期的时间虚拟变量的系数γ之差的指数减去1,如公式(2)。

$$ \text { Return } s_t=\operatorname{EXP}\left(\gamma_t-\gamma_{t-1}\right)-1 $$ (2) 表 5 无色钻石名义回报率及价格指数Table 5. Nominal return rates and price indexes for colourless diamonds时间 高品质 中品质 低品质 总样本 名义回报率/% 价格指数 名义回报率/% 价格指数 名义回报率/% 价格指数 名义回报率/% 价格指数 2009上 - 100.00 - 100.00 - 100.00 - 100.00 2009下 10.96 110.96 15.30 115.30 43.93 143.93 -0.05 99.95 2010上 11.93 124.20 21.13 139.66 1.95 146.74 13.00 112.94 2010下 -4.54 118.57 -9.75 126.05 11.39 163.46 2.14 115.36 2011上 42.89 169.42 33.52 168.30 -3.55 157.65 13.80 131.29 2011下 -12.22 148.73 -10.11 151.28 -2.64 153.48 0.10 131.42 2012上 -14.46 127.22 12.01 169.45 -3.25 148.49 -2.71 127.86 2012下 -24.07 96.60 21.51 205.90 7.00 158.87 -5.73 120.53 2013上 38.44 133.73 -33.35 137.24 12.19 178.23 -1.25 119.03 2013下 18.69 158.73 13.35 155.56 0.41 178.96 4.70 124.62 2014上 -6.94 147.72 0.79 156.79 1.60 181.82 -4.63 118.86 2014下 -17.38 122.05 -3.03 152.04 -20.76 144.08 1.69 120.87 2015上 7.52 131.23 -7.67 140.38 -11.19 127.96 -6.50 113.01 2015下 0.12 131.39 -5.10 133.22 2.33 130.95 -1.20 111.66 2016上 -17.04 109.00 -18.58 108.46 -18.16 107.17 -10.81 99.59 2016下 -24.73 82.04 3.60 112.36 22.53 131.31 -0.85 98.74 2017上 49.40 122.57 22.03 137.12 11.82 146.83 5.97 104.64 2017下 -12.49 107.25 -10.34 122.93 -6.59 137.16 -0.58 104.04 2018上 7.64 115.44 10.96 136.41 -9.97 123.48 0.62 104.68 2018下 -9.54 104.44 -18.40 111.31 17.92 145.61 -7.89 96.42 2019上 -25.91 77.37 6.92 119.01 15.92 168.78 1.08 97.46 2019下 -13.45 66.97 -22.13 92.68 -23.96 128.34 -1.08 96.41 2020上 14.53 76.70 45.34 134.70 -17.58 105.78 -4.00 92.56 2020下 -2.33 74.91 -38.97 82.21 6.90 113.07 -8.54 84.66 2021上 0.04 74.94 54.94 127.37 8.62 122.82 10.31 93.39 2021下 18.62 88.89 -21.25 100.30 36.77 167.98 2.18 95.42 2022上 6.81 94.95 58.15 158.62 8.75 182.68 18.27 112.86 2022下 -27.30 69.03 -11.13 140.97 -20.75 144.78 -8.19 103.61 由于收集到的其他资产指数是从2009年开始有记录的,为了方便后续收益情况的对比,本研究将2009年上半年设置为基准期,将2009年上半年无色钻石的相对价格水平设置为100.00。2009—2022年高品质无色钻石年均实际回报率为-10.14%,中品质的为-1.40%,低品质的为-5.31%,全样本为-8.08。

从价格指数来看,不同品质无色钻石在研究期内呈现大致相同的变化趋势。2011年以前,无色钻石价格指数均呈上升趋势;2011年下半年至2013年上半年,总体价格指数呈现平稳状态,但高品质钻石与中、低品质钻石呈现相反的变化趋势;2013年下半年至2016年下半年所有的价格指数均呈下降态势;2016-2018年上半年无色钻石市场趋于稳定状态;2018年下半年开始至2019年下半年价格指数整体呈下降态势,但在2020年后市场呈现回暖迹象。

总体而言,在研究期内,无色钻石似乎并不是一个很好的投资选择,高品质钻石名义回报率变动较为剧烈,且在研究期内整体呈现负回报状态。中、低等品质钻石作为单项资产,可以被纳入投资考量范围内,但需要把握好投资时机。在研究期内超一半时间,中、低质量无色钻石可实现正回报,但其回报的波动较大,且二者的年均实际回报率均为负。

2.3 无色钻石与其他资产投资回报对比

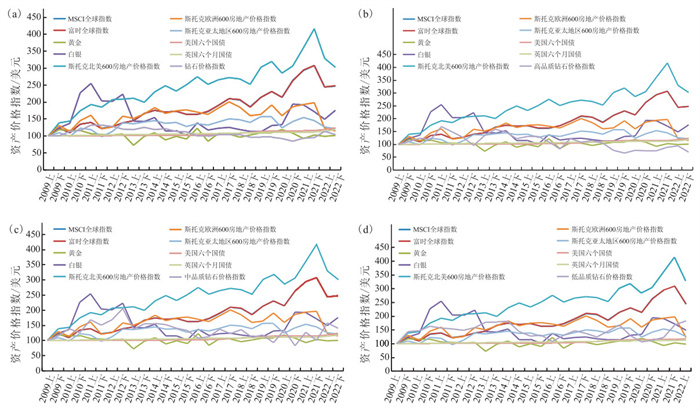

基于表 5中计算的无色钻石价格指数,我们在图 4中描绘了2009-2022年期间每半年期的无色钻石和其他类型资产(如全球股票(MSCI全球指数和富时全球指数)、债券(美国6个月国债指数和英国6个月国债指数)、房地产(斯托克北美600房地产价格指数、斯托克欧洲600房地产价格指数及斯托克亚太地区600房地产价格指数)、黄金(以每盎司/美金计算)、白银(以每盎司/美金计算))的价格指数值。所有指数均以名义值计算,将2009年上半年作为基期,指数值设置为100。上述各金融资产数据来自于英为财情(investing.com)。

图 4显示,2018年之前的大多数时间内,高品质无色钻石的表现优于黄金、美国和英国的6个月国债,但在2018年之后,其回报低于其他所有金融资产且呈现负回报状态。中、低品质无色钻石在整个研究期内指数表现(除2019、2020、2021的下半年外)均优于黄金、美国和英国的6个月国债。整体而言,各品质无色钻石在2015年前的收益率均高于亚太地区房地产,2013年前均高于欧洲房地产。纵观整个研究期,不论是全样本指数还是各品质无色钻石指数的收益情况远低于全球股票,只有在2012年之前的一段时间内略高于股票收益。

表 6为2009年至2022年无色钻石及各类金融资产(股票、债券、房地产、白银、黄金)的投资回报表现,包括名义及实际年化收益率、年化标准差、夏普比率,采用国际货币基金组织(Interntional Monetary Fund)发表的《世界经济展望》中的全球通货膨胀率,去除了通货膨胀因素对各个资产收益情况的影响。表 7展示了全样本及各品质无色钻石与各类资产收益率的相关性情况,以实际回报率计算。

表 6 无色钻石及其他金融资产回报Table 6. Returns on colourless diamonds and other financial assets投资资产 年化名义收益率/% 年化实际收益率/% 年化标准差(名义)/% 年化标准差(实际)/% 夏普比率(名义) 夏普比率(实际) 无色钻石 全样本 -0.08 -8.08 14.59 13.71 -0.115 -0.122 高品质 -2.14 -10.14 22.08 22.08 -0.170 -0.170 中品质 6.60 -1.40 24.71 24.34 0.203 0.206 低品质 2.86 -5.13 17.59 17.56 0.072 0.072 股票 MSCI全球指数 8.18 0.19 21.42 22.66 0.308 0.291 富时全球指数 8.24 0.25 21.51 22.74 0.309 0.293 贵金属 黄金 6.37 -1.63 21.05 21.55 0.227 0.222 白银 9.33 1.33 42.32 42.67 0.183 0.181 房地产 斯托克北美600房地产价格指数 8.09 0.09 25.63 26.53 0.254 0.245 斯托克欧洲600房地产价格指数 3.70 -4.29 30.73 32.08 0.069 0.066 斯托克亚太地区600房地产价格指数 3.22 -4.77 22.17 23.22 0.074 0.070 债券 美国六个国债 1.59 -6.40 2.25 2.62 NA NA 英国六个月国债 1.25 -6.75 1.49 2.29 NA NA 表 7 无色钻石及其他资产间的相关性Table 7. Correlation between colourless diamonds and other assets投资资产 相关性 总样本 高品质 中品质 低品质 MSCI全球股票指数 皮尔逊相关性 -0.210 -0.014 -0.244 0.277 显著性(双尾) 0.283 0.943 0.210 0.154 富时全球股票指数 皮尔逊相关性 -0.209 -0.023 -0.238 0.272 显著性(双尾) 0.286 0.909 0.222 0.162 黄金价格指数 皮尔逊相关性 -0.135 -0.102 0.094 -0.059 显著性(双尾) 0.492 0.606 0.634 0.764 白银价格指数 皮尔逊相关性 -0.243 -0.177 -0.154 -0.082 显著性(双尾) 0.212 0.368 0.435 0.679 斯托克北美600房地产价格指数 皮尔逊相关性 0.089 0.155 -0.047 0.494** 显著性(双尾) 0.654 0.430 0.813 0.008 斯托克欧洲600房地产价格指数 皮尔逊相关性 -0.233 0.023 -0.215 0.211 显著性(双尾) 0.234 0.907 0.272 0.280 斯托克亚太地区600房地产价格指数 皮尔逊相关性 -0.254 -0.237 -0.161 0.153 显著性(双尾) 0.193 0.224 0.413 0.438 美国六个月国债 皮尔逊相关性 -0.049 -0.242 -0.020 -0.139 显著性(双尾) 0.805 0.215 0.918 0.479 英国六个月国债 皮尔逊相关性 -0.006 -0.237 0.015 -0.244 显著性(双尾) 0.976 0.224 0.938 0.210 注:*,**,***分别表示在10,5,1水平上具有统计显著性 由表 6可知,2009年至2022年间拍卖市场无色钻石的实际年化回报率为均为负值,高品质无色钻石是所有资产中表现最差的,除年化回报率外,风险回报也为负值且最低,说明在这段时间内高品质无色钻石并不是一个好的投资选择;中等品质钻石是无色钻石中表现最佳的,虽然其实际回报率仍为负值,但与黄金、美国和英国的六个月债券以及欧洲和亚太地区房地产指数相比,其回报率表现较好。低品质无色钻石的回报率仅高于美国和英国的六个月债券,在研究期内作为单一投资资产不具有优势。全球股票的年化实际投资回报率为0.20%左右,除白银外在所有资产中表现最佳。在此期间,除全球股票、白银、北美房地产其余资产的实际年化回报均表现为负。与此同时, 白银展现了最好年化回报,但其风险回报率低于全球股票、黄金及北美房地产指数。

表 7显示,除低品质无色钻石在0.05的水平下与美国房地产指数显著相关外,其他品质无色钻石与传统的金融投资资产均不具有显著相关性。这表明,不论是高品质钻石还是中等品质钻石在纳入投资资产配置时均具有一定分散风险的能力。而低品质钻石不能分散北美房地产的风险,但可作为分散股票、债券、贵金属及以欧洲和亚太地区房地产投资风险的工具。综上所述,无色色钻石在纳入传统投资资产组合时具有较强的多元化潜力。

3. 讨论

利用2009-2022年国际拍卖市场的无色钻石真实交易数据对无色钻石价格影响因素、收益和避险能力展开调查,结果表明,除无色钻石的“4C”分级以外,钻石的品牌也是影响价格十分重要的因素,此外,研究期内不论是全样本还是各质量等级的无色钻石的实际投资回报均为负值,这可能因合成钻石技术日渐成熟的影响,大量合成钻石流入市场,对天然无色钻石市场造成冲击。作为单一投资资产,高品质无色钻石在研究期内表现最差,不是一个好的投资选择;中等品质钻石与同时期的股票相比,表现较差,但比同时期债券、贵金属以及房地产的投资表现好,且其收益与其他投资资产无显著相关性,可被纳入投资资产组合用于分担风险;低品质无色钻石不能作为分散北美房地产投资风险的工具,但可作为其他金融资产的多元化工具。

需要注意的本文旨在描述一段较短时间内拍卖市场无色钻石的收益情况,并不是要准确衡量不同投资资产的历史表现,所以不同的研究期的不同等级质量无色钻石的投资收益和避险能力会有差异。理想情况下,将钻石的价格趋势与较长时期内的金融资产和实物资产的价格趋势进行比较是很重要的。

4. 结论

本文对影响无色钻石拍卖价格的因素和钻石是否有潜力成为投资和投资组合构建决策中值得考虑的资产这两个问题进行了探讨,结果如下。

(1) 无色钻石拍卖价格受到多种因素综合影响,其中重量、色级、净度、琢型等质量特征是影响其价格的重要因素。随着重量、色级、净度评级的下降无色钻石会出现相应的折价。此外,钻石来自奢侈品品牌会给其带来较高的溢价。

(2) 2009—2022年,拍卖市场上不同品质无色钻石展现出的回报水平有差异。在研究期间,高品质无色钻石的投资回报表现最差,作为投资单品不是一个很好的选择;中等质量无色钻石表现次于股票、但优于贵金属和债券,可作为投资资产纳入考量范围。其他时期无色钻石的投资、保值增值能力还有待研究。

(3) 在传统投资组合中,纳入无色钻石具有一定分散风险的优势。除低品质无色钻石与美国房地产指数存在显著正相关外,拍卖市场其他品质无色钻石收益与传统金融资产收益在2009-2022年间均不存在显著的相关性。

-

表 1 2008年至2022年无色钻石裸石及单独镶嵌无色钻石拍卖价格统计

Table 1 Statistics of auction prices of colourless diamond loose stones and individually inlaid colourless diamonds from 2008 to 2022

时间 样本量/件 平均价格/万美元 平均克拉单价/万美元 最高价/万美元 最低价/万美元 2008上 61 22.517 2.862 334.181 0.144 2008下 82 12.301 1.778 189.114 0.185 2009上 51 13.198 1.999 151.579 0.182 2009下 54 15.583 1.464 411.450 0.236 2010上 109 28.971 2.503 797.439 0.318 2010下 172 14.519 1.892 366.650 0.234 2011上 149 31.541 2.594 1 094.030 0.110 2011下 111 29.881 2.837 827.696 0.256 2012上 101 23.286 2.478 397.973 0.268 2012下 88 22.238 2.086 344.250 0.150 2013上 151 30.566 2.044 1 416.500 0.134 2013下 127 51.960 2.798 3 077.950 0.095 2014上 172 56.530 2.507 1 466.740 0.373 2014下 172 27.188 2.334 1 108.500 0.255 2015下 167 45.157 2.459 2 209.000 0.148 2015下 132 28.948 2.347 783.472 0.373 2016上 131 29.250 2.069 722.100 0.283 2016下 114 17.127 1.613 556.750 0.166 2017上 133 25.022 2.139 524.299 0.375 2017下 185 17.484 1.837 498.197 0.364 2018上 145 35.185 2.278 926.164 0.350 2018下 197 17.230 1.622 397.500 0.303 2019上 117 35.712 1.989 1 375.760 0.259 2019下 71 17.807 1.920 182.765 0.252 2020上 34 13.534 1.736 211.500 0.202 2020下 78 38.749 1.677 1 568.560 0.199 2021上 82 65.244 3.192 1 412.510 0.138 2021下 41 64.624 3.207 529.513 0.336 2022上 333 19.554 1.410 2 183.160 0.050 2022下 181 13.100 1.548 296.570 0.060 总计 3 741 28.800 2.174 878.729 0.227 注:“时间”中的“上”表示当年的上半年,“下”表示当年的下半年 表 2 享乐模型特征变量描述性统计

Table 2 Descriptive statistics of characteristic variables in the hedonic pricing model

色级 样本/件 占比/% 净度 样本/件 占比/% 琢形 样本/件 占比/% D 630 16.84 FL 117 3.13 其他 78 2.09 E 341 9.12 IF 288 7.70 圆型 2 460 65.76 F 332 8.87 VVS 923 24.67 垫型 157 4.20 G 319 8.53 VS 1 569 41.94 心型 120 3.21 H 275 7.35 SI 649 17.35 方型 513 13.71 I-J 608 16.25 SI以下 188 5.03 梨型 224 5.99 M-Z 685 18.31 其他 7 0.19 椭圆型 68 1.82 其他 77 2.06 橄榄型 121 3.23 拍卖行 样本/件 占比/% 拍卖地 样本/件 占比/% 品牌 样本/件 占比/% 佳士得 1 096 29.30 中国 468 12.51 国际知名品牌 286 7.65 苏富比 1 671 44.67 其他 39 1.04 未披露 3 455 92.35 邦瀚斯 875 23.39 意大利 69 1.84 证书 样本/件 占比/% 其他 99 2.65 法国 236 6.31 有证书 2 403 64.23 澳大利亚 68 1.82 未披露 1 338 35.77 注:“色级”“净度”中的“其他”表示该项未标明;“琢型”中“其他”表示不属于常见琢型;“拍卖行”中“其他”表示保利、中国嘉德、北京瀚海、北京匡时和菲利普斯;拍卖地中“其他”表示荷兰、阿联酋;合计样本量3 741件 表 3 享乐回归结果

Table 3 Results of hedonic regression

影响因素 系数 标准差 t P>t 影响/% 重量 ln(克拉重量) 1.915 0.021 89.510 0 578.5 ln(克拉重量)2 -0.062 0.006 -10.990 0 -6.0 色级 D Benchmark - - - - E -0.253 0.025 -9.920 0 -22.3 F -0.356 0.026 -13.720 0 -30.0 G -0.479 0.026 -18.100 0 -38.1 H -0.647 0.028 -23.110 0 -47.7 I-J -0.899 0.024 -37.310 0 -59.3 K-L -1.306 0.027 -48.340 0 -72.9 M-Z -1.645 0.026 -63.710 0 -80.7 未标明 -1.588 0.048 -33.010 0 -79.6 净度 FL Benchmark - - - - IF -0.108 0.041 -2.620 0.009 -10.2 VVS -0.400 0.039 -10.240 0 -33.0 VS -0.569 0.039 -14.520 0 -43.4 SI -0.785 0.042 -18.900 0 -54.4 SI以下 -1.103 0.048 -23.030 0 -66.8 未标明 -1.001 0.141 -7.100 0 -63.3 琢形 橄榄型 Benchmark - - - - 其他 0.022 0.055 0.410 0.682 2.3 圆型 0.119 0.034 3.450 0.001 12.6 垫型 0.071 0.044 1.600 0.110 7.3 心型 -0.076 0.047 -1.630 0.104 -7.3 方型 -0.078 0.037 -2.140 0.032 -7.5 梨型 -0.028 0.041 -0.680 0.496 -2.7 椭圆型 0.001 0.055 0.010 0.992 0.1 品牌 未披露 Benchmark - - - - 国际知名品牌 0.175 0.023 7.750 0 19.1 证书 未披露 Benchmark - - - - 有证书 -0.002 0.018 -0.120 0.903 -0.2 地点 英国 Benchmark - - - - 中国 0.260 0.025 10.340 0.000 29.7 其他 -0.031 0.061 -0.500 0.616 -3.0 意大利 -0.110 0.049 -2.240 0.025 -10.4 法国 0.007 0.028 0.240 0.808 0.7 澳大利亚 -0.049 0.047 -1.060 0.289 -4.8 瑞士 0.127 0.020 6.360 0.000 13.6 线上 0.065 0.045 1.450 0.146 6.7 美国 0.090 0.019 4.710 0.000 9.4 拍卖行 佳士得 Benchmark - - - - 苏富比 -0.016 0.016 -1.000 0.319 -1.5 邦瀚斯 -0.157 0.022 -7.240 0 -14.6 其他 0.067 0.041 1.630 0.103 7.0 Prob >F=0 R2=0.950 9 N=3 741 Adj R2=0.950 1 注:“琢型”中“其他”表示不属于常见琢型;“地点”中“其他”表示日内瓦、荷兰、阿联酋;“拍卖行”中的“其他”表示保利、中国嘉德、北京瀚海、北京匡时、菲利普斯 表 4 全样本及分位数享乐回归结果

Table 4 Full sample and quantile hedonic regression results

影响因素 全样本 0.3 0.5 0.7 系数 标准差 系数 标准差 系数 标准差 系数 标准差 重量 ln(克拉重量) 1.915*** 0.021 2.051*** 0.031 2.026*** 0.029 2.044*** 0.034 ln(克拉重量)2 -0.062*** 0.006 -0.092*** 0.008 -0.084*** 0.007 -0.087*** 0.010 色级 D Benchmark - Benchmark - Benchmark - Benchmark - E -0.253 *** 0.025 -0.227*** 0.031 -0.229*** 0.031 -0.254*** 0.037 F -0.356*** 0.026 -0.311*** 0.027 -0.356*** 0.026 -0.367*** 0.032 G -0.479*** 0.026 -0.415*** 0.028 -0.452*** 0.025 -0.455*** 0.032 H -0.647*** 0.028 -0.561*** 0.031 -0.598*** 0.030 -0.637*** 0.032 I-J -0.899*** 0.024 -0.878*** 0.024 -0.897*** 0.031 -0.919*** 0.036 K-L -1.306*** 0.027 -1.309*** 0.033 -1.298*** 0.035 -1.300*** 0.042 M-Z -1.645*** 0.026 -1.649*** 0.031 -1.677*** 0.031 -1.725*** 0.043 未标明 -1.588*** 0.048 -1.644*** 0.042 -1.681*** 0.059 -1.692*** 0.080 净度 FL Benchmark - Benchmark - Benchmark - Benchmark - IF -0.108*** 0.041 -0.149*** 0.056 -0.127** 0.054 -0.151** 0.059 VVS -0.400*** 0.039 -0.432*** 0.051 -0.411*** 0.052 -0.397*** 0.065 VS -0.569*** 0.039 -0.592*** 0.049 -0.586*** 0.051 -0.575*** 0.062 SI -0.785*** 0.042 -0.827*** 0.049 -0.787*** 0.053 -0.760*** 0.065 SI以下 -1.103*** 0.048 -1.182 *** 0.063 -1.037*** 0.077 -0.979*** 0.071 未标明 -1.001*** 0.141 -0.975*** 0.544 -1.003** 0.432 -0.554 0.458 琢型 橄榄型 Benchmark - Benchmark - Benchmark - Benchmark - 其他 0.022 0.055 0.101 0.065 0.085 0.065 0.073 0.071 圆型 0.119*** 0.034 0.150*** 0.052 0.158*** 0.042 0.157*** 0.035 垫型 0.071 0.044 0.061 0.054 0.051 0.051 0.087 0.053 心型 -0.076 0.047 -0.071 0.057 -0.043 0.056 -0.009 0.047 方型 -0.078** 0.037 -0.067 0.052 -0.051 0.043 -0.067* 0.038 梨型 -0.028 0.041 -0.036 0.062 -0.021 0.053 0.013 0.047 椭圆型 0.001 0.055 0.048 0.076 0.017 0.060 -0.007 0.057 品牌 未披露 Benchmark - Benchmark - Benchmark - Benchmark - 国际知名品牌 0.175*** 0.023 0.116*** 0.026 0.153*** 0.034 0.220*** 0.032 证书 未披露 Benchmark - Benchmark - Benchmark - Benchmark - 有证书 -0.002 0.018 -0.021 0.018 0 0.020 -0.009 0.019 地点 英国 Benchmark - Benchmark - Benchmark - Benchmark - 中国 0.260*** 0.025 0.269*** 0.023 0.259*** 0.030 0.297*** 0.028 其他 -0.031 0.061 0.105 0.082 0.082 0.062 0.149* 0.087 意大利 -0.110** 0.049 -0.073 0.046 -0.059 0.062 -0.063 0.050 法国 0.007 0.028 -0.017 0.026 -0.045* 0.025 -0.045 0.035 澳大利亚 -0.049 0.047 -0.029 0.047 -0.047 0.042 -0.053 0.051 瑞士 0.127*** 0.020 0.155*** 0.018 0.132*** 0.021 0.142*** 0.021 线上 0.065 0.045 -0.111 0.045 -0.173 0.052 -0.127 0.057 美国 0.090*** 0.019 0.107*** 0.016 0.084*** 0.019 0.072*** 0.017 拍卖行 佳士得 Benchmark - Benchmark - Benchmark - Benchmark - 苏富比 -0.016 0.016 -0.025 0.016 -0.016 0.017 -0.024 0.018 邦瀚斯 -0.157*** 0.022 -0.044** 0.022 -0.060** 0.024 -0.076*** 0.025 其他 0.067 0.041 -0.091 0.058 0.022 0.053 0.009 0.051 注:“*”“**”“***”分别表示在10%,5%,1%水平上具有统计显著性;“地点”中的“其他”表示日内瓦、荷兰、阿联酋;“拍卖行”中“其他”表示保利、中国嘉德、北京瀚海、北京匡时、菲利普斯 表 5 无色钻石名义回报率及价格指数

Table 5 Nominal return rates and price indexes for colourless diamonds

时间 高品质 中品质 低品质 总样本 名义回报率/% 价格指数 名义回报率/% 价格指数 名义回报率/% 价格指数 名义回报率/% 价格指数 2009上 - 100.00 - 100.00 - 100.00 - 100.00 2009下 10.96 110.96 15.30 115.30 43.93 143.93 -0.05 99.95 2010上 11.93 124.20 21.13 139.66 1.95 146.74 13.00 112.94 2010下 -4.54 118.57 -9.75 126.05 11.39 163.46 2.14 115.36 2011上 42.89 169.42 33.52 168.30 -3.55 157.65 13.80 131.29 2011下 -12.22 148.73 -10.11 151.28 -2.64 153.48 0.10 131.42 2012上 -14.46 127.22 12.01 169.45 -3.25 148.49 -2.71 127.86 2012下 -24.07 96.60 21.51 205.90 7.00 158.87 -5.73 120.53 2013上 38.44 133.73 -33.35 137.24 12.19 178.23 -1.25 119.03 2013下 18.69 158.73 13.35 155.56 0.41 178.96 4.70 124.62 2014上 -6.94 147.72 0.79 156.79 1.60 181.82 -4.63 118.86 2014下 -17.38 122.05 -3.03 152.04 -20.76 144.08 1.69 120.87 2015上 7.52 131.23 -7.67 140.38 -11.19 127.96 -6.50 113.01 2015下 0.12 131.39 -5.10 133.22 2.33 130.95 -1.20 111.66 2016上 -17.04 109.00 -18.58 108.46 -18.16 107.17 -10.81 99.59 2016下 -24.73 82.04 3.60 112.36 22.53 131.31 -0.85 98.74 2017上 49.40 122.57 22.03 137.12 11.82 146.83 5.97 104.64 2017下 -12.49 107.25 -10.34 122.93 -6.59 137.16 -0.58 104.04 2018上 7.64 115.44 10.96 136.41 -9.97 123.48 0.62 104.68 2018下 -9.54 104.44 -18.40 111.31 17.92 145.61 -7.89 96.42 2019上 -25.91 77.37 6.92 119.01 15.92 168.78 1.08 97.46 2019下 -13.45 66.97 -22.13 92.68 -23.96 128.34 -1.08 96.41 2020上 14.53 76.70 45.34 134.70 -17.58 105.78 -4.00 92.56 2020下 -2.33 74.91 -38.97 82.21 6.90 113.07 -8.54 84.66 2021上 0.04 74.94 54.94 127.37 8.62 122.82 10.31 93.39 2021下 18.62 88.89 -21.25 100.30 36.77 167.98 2.18 95.42 2022上 6.81 94.95 58.15 158.62 8.75 182.68 18.27 112.86 2022下 -27.30 69.03 -11.13 140.97 -20.75 144.78 -8.19 103.61 表 6 无色钻石及其他金融资产回报

Table 6 Returns on colourless diamonds and other financial assets

投资资产 年化名义收益率/% 年化实际收益率/% 年化标准差(名义)/% 年化标准差(实际)/% 夏普比率(名义) 夏普比率(实际) 无色钻石 全样本 -0.08 -8.08 14.59 13.71 -0.115 -0.122 高品质 -2.14 -10.14 22.08 22.08 -0.170 -0.170 中品质 6.60 -1.40 24.71 24.34 0.203 0.206 低品质 2.86 -5.13 17.59 17.56 0.072 0.072 股票 MSCI全球指数 8.18 0.19 21.42 22.66 0.308 0.291 富时全球指数 8.24 0.25 21.51 22.74 0.309 0.293 贵金属 黄金 6.37 -1.63 21.05 21.55 0.227 0.222 白银 9.33 1.33 42.32 42.67 0.183 0.181 房地产 斯托克北美600房地产价格指数 8.09 0.09 25.63 26.53 0.254 0.245 斯托克欧洲600房地产价格指数 3.70 -4.29 30.73 32.08 0.069 0.066 斯托克亚太地区600房地产价格指数 3.22 -4.77 22.17 23.22 0.074 0.070 债券 美国六个国债 1.59 -6.40 2.25 2.62 NA NA 英国六个月国债 1.25 -6.75 1.49 2.29 NA NA 表 7 无色钻石及其他资产间的相关性

Table 7 Correlation between colourless diamonds and other assets

投资资产 相关性 总样本 高品质 中品质 低品质 MSCI全球股票指数 皮尔逊相关性 -0.210 -0.014 -0.244 0.277 显著性(双尾) 0.283 0.943 0.210 0.154 富时全球股票指数 皮尔逊相关性 -0.209 -0.023 -0.238 0.272 显著性(双尾) 0.286 0.909 0.222 0.162 黄金价格指数 皮尔逊相关性 -0.135 -0.102 0.094 -0.059 显著性(双尾) 0.492 0.606 0.634 0.764 白银价格指数 皮尔逊相关性 -0.243 -0.177 -0.154 -0.082 显著性(双尾) 0.212 0.368 0.435 0.679 斯托克北美600房地产价格指数 皮尔逊相关性 0.089 0.155 -0.047 0.494** 显著性(双尾) 0.654 0.430 0.813 0.008 斯托克欧洲600房地产价格指数 皮尔逊相关性 -0.233 0.023 -0.215 0.211 显著性(双尾) 0.234 0.907 0.272 0.280 斯托克亚太地区600房地产价格指数 皮尔逊相关性 -0.254 -0.237 -0.161 0.153 显著性(双尾) 0.193 0.224 0.413 0.438 美国六个月国债 皮尔逊相关性 -0.049 -0.242 -0.020 -0.139 显著性(双尾) 0.805 0.215 0.918 0.479 英国六个月国债 皮尔逊相关性 -0.006 -0.237 0.015 -0.244 显著性(双尾) 0.976 0.224 0.938 0.210 注:*,**,***分别表示在10,5,1水平上具有统计显著性 -

[1] 刘勇军, 伍健栋, 张卫国. 具有灵活时间期限的混合投资组合优化模型[J]. 中国管理科学, 2024, 32(1): 23-30. Liu Y J, Wu J D, Zhang W G. Mixed portfolio optimization model within flexible time horizon[J]. Chinese Journal of Management Science, 2024, 32(1): 23-30. (in Chinese)

[2] Hillier D, Draper P, Faff R. Do precious metals shine? An investment perspective[J]. Financial Analysts Journal, 2006, 62(2): 98-106. doi: 10.2469/faj.v62.n2.4085

[3] Baur D G, Lucey B M. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold[J]. Financial Review, 2010, 45(2): 217-229. doi: 10.1111/j.1540-6288.2010.00244.x

[4] Baur D G, McDermott T K. Is gold a safe haven? International evidence[J]. Journal of Banking & Finance, 2010, 34(8): 1 886-1 898.

[5] Reboredo J C. Is gold a safe haven or a hedge for the US dollar? Implications for risk management[J]. Journal of Banking & Finance, 2013, 37(8): 2 665-2 676.

[6] Bredin D, Conlon T, Potì V. Does gold glitter in the long-run? Gold as a hedge and safe haven across time and investment horizon[J]. International Review of Financial Analysis, 2015(41): 320-328.

[7] Baur D G, McDermott T K J. Why is gold a safe haven?[J]. Journal of Behavioral and Experimental Finance, 2016(10): 63-71.

[8] Iqbal J. Does gold hedge stock market, inflation and exchange rate risks? An econometric investigation[J]. International Review of Economics & Finance, 2017(48): 1-17.

[9] 郭杨莉, 马锋. 基于马尔科夫和混频数据模型的黄金期货市场波动率预测研究[J]. 中国管理科学, 2024, 32(1): 13-22. Guo Y L, Ma F. Forecasting the Chinese gold futures market volatility using Markov-Switching regime and mixed data sampling model[J]. Chinese Journal of Management Science, 2024, 32(1): 13-22. (in Chinese)

[10] Song Y, Song Y, Chang S, et al. The role of gold in terrorism: Risk aversion or financing source?[J]. Resources Policy, 2024(95): 105 201.

[11] Ngo V M, Van Nguyen P, Hoang Y H. The impacts of geopolitical risks on gold, oil and financial reserve management[J]. Resources Policy, 2024(90): 104 688.

[12] Terraza V, Boru pek A, Rounaghi M M. The nexus between the volatility of Bitcoin, gold, and American stock markets during the COVID-19 pandemic: Evidence from VAR-DCC-EGARCH and ANN models[J]. Financial Innovation, 2024, 10(1): 22. doi: 10.1186/s40854-023-00520-3

[13] Yang M, Wang R, Zeng Z, et al. Improved prediction of global gold prices: An innovative Hurst-reconfiguration-based machine learning approach[J]. Resources Policy, 2024(88): 104 430.

[14] Ibrahim B A, Elamer A A, Alasker T H, et al. Volatility contagion between cryptocurrencies, gold and stock markets pre-and-during COVID-19: Evidence using DCC-GARCH and cascade-correlation network[J]. Financial Innovation, 2024, 10(1): 104. doi: 10.1186/s40854-023-00605-z

[15] Conover C M, Jensen G R, Johnson R R, et al. Can precious metals make your portfolio shine?[J]. Journal of Investing, 2009, 18(1): 75-86. doi: 10.3905/JOI.2009.18.1.075

[16] Belousova J, Dorfleitner G. On the diversification benefits of commodities from the perspective of euro investors[J]. Journal of Banking & Finance, 2012, 36(9): 2 455-2 472.

[17] Lucey B M, Li S. What precious metals act as safe havens, and when? Some US evidence[J]. Applied Economics Letters, 2015, 22(1): 35-45. doi: 10.1080/13504851.2014.920471

[18] Bredin D, Conlon T, Potì V. The price of shelter-Downside risk reduction with precious metals[J]. International Review of Financial Analysis, 2017(49): 48-58.

[19] Bedoui R, Guesmi K, Kalai S, et al. Diamonds versus precious metals: What gleams most against USD exchange rates?[J]. Finance Research Letters, 2020(34): 101 253.

[20] Plastun A, Bouri E, Havrylina A, et al. Calendar anomalies in passion investments: Price patterns and profit opportunities[J]. Research in International Business and Finance, 2022(61): 101 678.

[21] Thomsen L, Hess M. Dialectics of association and dissociation: Spaces of valuation, trade, and retail in the gemstone and jewelry sector[J]. Economic Geography, 2022, 98(1): 49-67. doi: 10.1080/00130095.2021.1989302

[22] Potrykus M. Diamond investments-Is the market free from multiple price bubbles?[J]. International Review of Financial Analysis, 2022(83): 102 329.

[23] Auer B R, Schuhmacher F. Diamonds-A precious new asset?[J]. International Review of Financial Analysis, 2013(28): 182-189.

[24] Auer B R. Could diamonds become an investor's best friend?[J]. Review of Managerial Science, 2014(8): 351-383.

[25] Low R K Y, Yao Y, Faff R. Diamonds vs. precious metals: What shines brightest in your investment portfolio?[J]. International Review of Financial Analysis, 2016(43): 1-14.

[26] D'Ecclesia R L, Jotanovic V. Are diamonds a safe haven?[J]. Review of Managerial Science, 2018(12): 937-968.

[27] Renneboog L, Spaenjers C. Hard assets: The returns on rare diamonds and gems[J]. Finance Research Letters, 2012, 9(4): 220-230. doi: 10.1016/j.frl.2012.07.003

[28] Jotanovic V, D'Ecclesia R L. Do diamond stocks shine brighter than diamonds?[J]. Journal of Risk and Financial Management, 2019, 12(2): 79. doi: 10.3390/jrfm12020079

[29] Barbi M, Geman H, Romagnoli S. Diamonds and precious metals for reduction of portfolio tail risk[J]. Applied Economics, 2020, 52(26): 2 841-2 861. doi: 10.1080/00036846.2019.1696938

[30] Yousaf I, Assaf A, Demir E. Relationship between real estate tokens and other asset classes: Evidence from quantile connectedness approach[J]. Research in International Business and Finance, 2024(69): 102 238.

[31] Botha F, Snowball J, Scott B. Art investment in South Africa: Portfolio diversification and art market efficiency[J]. South African Journal of Economic and Management Sciences, 2016, 19(3): 358-368. doi: 10.4102/sajems.v19i3.1397

[32] Park H, Ju L, Liang T, et al. Horizon analysis of art investments: Evidence from the Chinese market[J]. Pacific-Basin Finance Journal, 2017(41): 17-25.

[33] Wang F. Which part of the Chinese art market is more worth investing in? Applying the quantile regression to analyze Chinese oil paintings 2000-2014[J]. Emerging Markets Finance and Trade, 2017, 53(1): 44-53. doi: 10.1080/1540496X.2016.1145113

[34] Pownall R A J, Satchell S, Srivastava N. A random walk through Mayfair: Art as a luxury good and evidence from dynamic models[J]. Journal of International Money and Finance, 2019(95): 112-127.

[35] Santana V L. Art as investment: Construction of a hedonic index to measure the valuation of Colombian art in the 1989-2015 period[J]. Cuadernos de Economía, 2020, 39(79): 167-190. doi: 10.15446/cuad.econ.v39n79.71870

[36] Zou L, De Bruin A, Wu J, et al. Art for art's sake? An exploration of the Chinese art market[J]. Applied Economics, 2021, 53(47): 5 429-5 447. doi: 10.1080/00036846.2021.1923635

[37] Yilmaz T, Sagfossen S, Velasco C. What makes NFTs valuable to consumers? Perceived value drivers associated with NFTs liking, purchasing, and holding[J]. Journal of Business Research, 2023(165): 114 056.

[38] Etro F. Art and markets in the Greco-Roman world[J]. The Journal of Economic History, 2024, 84(2): 432-478. doi: 10.1017/S002205072400010X

[39] Kräussl R, Tugnetti A. Non-fungible tokens (NFTs): A review of pricing determinants, applications and opportunities[J]. Journal of Economic Surveys, 2024, 38(2): 555-574. doi: 10.1111/joes.12597

[40] Jaeger E. To save or savor: The rate of return to storing wine[J]. Journal of Political Economy, 1981, 89(3): 584-592. doi: 10.1086/260988

[41] Kourtis A, Markellos R N, Psychoyios D. Wine price risk management: International diversification and derivative instruments[J]. International Review of Financial Analysis, 2012(22): 30-37.

[42] Lucey B M, Devine L. Was wine a premier cru investment?[J]. Research in International Business and Finance, 2015(34): 33-51.

[43] Dimson E, Rousseau P L, Spaenjers C. The price of wine[J]. Journal of Financial Economics, 2015, 118(2): 431-449. doi: 10.1016/j.jfineco.2015.08.005

[44] Aytaç B, Mandou C. Wine: To drink or invest in? A study of wine as an investment asset in French portfolios[J]. Research in International Business and Finance, 2016(36): 591-614.

[45] Hekimoǧlu M H, Kazaz B, Webster S. Wine analytics: Fine wine pricing and selection under weather and market uncertainty[J]. Manufacturing & Service Operations Management, 2017, 19(2): 202-215.

[46] Cardebat J M, Jiao L. The long-term financial drivers of fine wine prices: The role of emerging markets[J]. The Quarterly Review of Economics and Finance, 2018(67): 347-361.

[47] Ameur H B, Le Fur E. Volatility transmission to the fine wine market[J]. Economic Modelling, 2020(85): 307-316.

[48] Potrykus M. Investing in wine, precious metals and G-7 stock markets-A co-occurrence analysis for price bubbles[J]. International Review of Financial Analysis, 2023(87): 102 637.

下载:

下载: